Saving in an alkansiya or piggy bank has always been part of the Filipino culture. Our forefathers have been saving money at home using whatever materials were at hand: bamboo tubes, biscuit tins, plastic jars, and even hollowed out, dried coconut shells. This is also how most of us were first taught to save and secure our money.

In this modern age, however, where banks and mobile wallets are just within everyone’s reach, is saving using an alkansiya still wise? Well, yes and no. First of all, supporting a child in learning to save money is hands down a great idea. Go for it! Get a cute coin bank or simply use a traditional alkansiya. Saving money is the most basic financial skill your child needs to learn.

But this does not mean your child should stay with a piggy bank forever. Once the coin bank is full and you need to break it and pour out its contents, praise your child and don’t get another coin bank. That’s because you’ll need to teach your child to level up and move on to the next step: a savings account. There are several good reasons for this:

Safety and security. Cash that is kept at home is not that secure. It can be stolen, degrade with time, or even lose value. From time to time, we read news about those who lost their money after storing it at home or after pests damaged the bills kept in cans or drawers. So yes, by all means, encourage your child to use a piggy bank for a while, and when it’s full, put the money in a savings account.

Savings accounts are life lessons. Having your child open and maintain a savings account in a bank is the first step towards a financially secure future. As they grow older, they will learn more financial skills along the way—such as wise spending, sticking to a budget, investing, and getting insurance—that would protect them from poverty and debt, allow them to build their wealth, and secure their future for a lifetime.

Literacy in a digital world . The world’s financial system has shifted towards digital since the 1980s. Anyone who wants to make a living, earn money, and build wealth needs to understand and use digital banking. Teaching your child to use a savings account now will prepare them better for the digital world of finance.

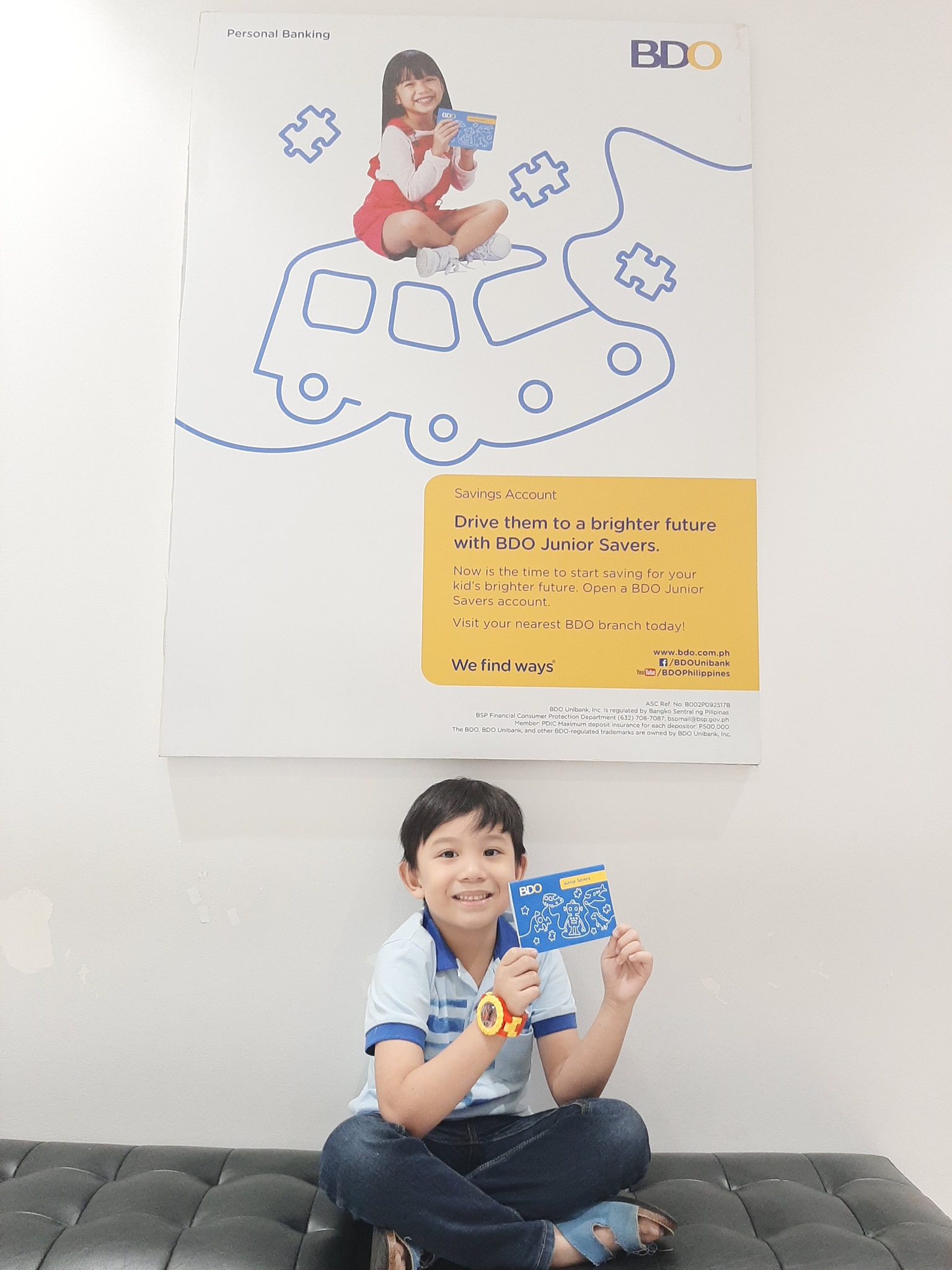

Fortunately, it is now easy for parents to open a savings account for their children. One example is the BDO Junior Savers Account. With minimal requirements and an affordable initial deposit and maintaining balance, it’s a breeze to visit a bank branch and put the money from the alkansiya into your child’s bank account.

The bank even makes it easier for you to help your kids grow their savings through the Junior Savers Plan. This allows you to add to your kids’ savings by scheduling regular deposits using your BDO Online Banking Account. Just set the amount and frequency of transfer and you can easily build their savings and teach them more money lessons.

The alkansiya or piggy bank is part of Filipino culture and heritage. As parents, we can use it as a means to instill the basic value and habit of savings to our children—then when it’s time to break piggy open, let’s put our child on a journey to financial freedom and security through their savings account.

Napakagaling naman ni kuya ma talagang super enjoy den sya sa pag iipon nya tama lang po yan na hanggat bata pa eh matuto na kung paano ang pagiipon para sa future dabest talaga si bdo .

LikeLike

Ang galing naman po,maganda po naatuto sng mga bata magipon buti at meron bdo na mpagkakatiwalaan sa ating mga savings nakapa lakong tulong na at sigurado tayo na sa bdo safe ang savings mo🥰❤️

LikeLike

Maganda talagang habang Bata pa sila matuto na silang makapaipon. Tska Yung needs VS wants ay mapractice nila at the same time. Good thing na mayroong BDO JUNIORS PLAN savings bank for kids dito talagang safe at secured Ang pera nila.. 😊

LikeLike

I can’t agree more! I started a fund for my kid when he was first born…Very important.

LikeLike

Thanks for this mommie napaka importante talaga kapag tinuturuan mo na ang mga bata na mag save habang maliit pa. And good think may BDO Junior Savers Account dahil matuto pa ang mga anak natin mag save kada buwan 💛

LikeLike

Good think talaga na meron ang BDO na Junior Savers Account dahil matuturuan natin sila na magsave at magkaroon ng disiplina sa sarili .And every month matuto silang maggtipid 💛 salamat at may bdo na mapagkakatiwalaan .

LikeLike

Good think talaga na meron Junior Savers account ang BDO dahil matuturuan natin na mag save ang mga bata at magkaroon ng disiplina ang mga anak natin sa paghawak ng pera. Salamat Bdo 💛

LikeLike

Wow nice babyboy🥰.tama po habang bata pa mga anak natin turuan natin sila mag save ng money para alam nila yong halaga neto.at matututunan nila kung paano mag tipid.hirap sa panahon ngayon kailangan talaga kahit paunti unti may ipon para incase of emergency may madudukot man.at para nadin sa magandang future nila.buti nalang may kapartner na tayo sa pag iipon safe na safe ang pera natin😊❤️#BDOJUNIORSAVERACCOUNT💙💙💙

LikeLike

At First We introduced Piggy bank for my eldest when he was 4 years old..This is the first way that we teach to him on how to save money then we start to open A Junior saver account for him.When his small piggy bank were full we saved this to his Bank Account to keep his Money safe and for his future

LikeLike

Mahalaga talaga na habang bata palang naturuan na natin sila kung pano mag ipon para sa future nila or para sa encase of emergency nadin po dahil kapag natuto na sila always na nila gagawin ang pag iipon at wag gastos ng gastos ng pera sa Hindi naman mahalaga na bagay

LikeLike

Very good baby boy,habang bata kapa natututo kana paano pahalagaan ang pera❤️maganda talaga na marunong tao mag save mg pera natin para sa oras ng kagipitan meron tayong maaasahan❤️

LikeLike

Very good yan baby boy na natututo kapaano mag ipon,npaka importante talaga na meron tayo ipon meron tauo madudukot sa oras ng pangangailangan

LikeLike

Iba po talaga pag alam na nila ung pag iipon lalo na pag may gusto po silang bilhin na laruan pero ung anak ko pag nababawasan ung barya nya sa alkansya nagagalit po 😁 sorry naman po … Nice BDo pwede narin pala ang mga Bata mag impok nang kanilang money lalo na sa darating na pasko po.. thanks for sharing ☺️

LikeLike

Yes and yes Po mommy.. yes for teaching our child to save and yes for keeping his or her savings safe on a bank.it’s wise to save first on a piggy bank but the wisest when we encourage our sons and daughters to save it on a bank..most probably the safest too… saving is the basic financial skill we can teach our child and other skills like wise spending,sticking on a budget, investing and getting insurance follows as they get older.. this will surely give them financial stability and avoid debt in the future.. perhaps,financial literacy is another intangible richness we can pass on to our children .

LikeLike

Magandang malaman at maituro natin sa ating mga anak ang kahalagahan ng pag iipon ng pera kahit pa nasa murang edad palang..Napaka importante talaga nitong savings ma para sa future din naman nila mapupunta ito..Ang maganda dito dahil sa BDO may programang pwedi natin pagkakatiwalaan at kasamang mag plano ng magandang kinabukasan para sa ating mga anak.

LikeLike

That’s a good way yo start kids on saving. My daughter alse have hers and evry after Christmas we break it open and df eposit the money to her BDO Junior Saver

LikeLike

I was taught to save up for the things I want the very same way.

LikeLike

I started when I was young too so bought my kids piggy banks so they’ll learn to save. BDO junior din sila

LikeLike

I agree. We need to start them young ❤

LikeLike

sounds like a wonderful idea for any child and his or her future. wonderful points

LikeLike